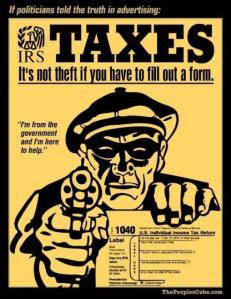

Probably the strongest consensus among free market Capitalists is that taxation is theft. It’s a phrase so well-known in liberty-loving circles that the words themselves have turned into a meme. But uttering those three words alone are not enough – they offer no explanation, no reasoning, and no solution (other than perhaps to stop taxing people, but that wouldn’t really help things, right? We’d run into an even larger deficit and our economy would collapse, right?). So what information should be given to accompany this phrase, to give it better credibility?

First, it must be said why taxation is theft. After all, didn’t former Supreme Court Justice Oliver Wendell Holmes say it best? “Taxes are the price we pay for a civilized society.” That sounds reasonable. Civilized society is nice, so taxes are how we keep it that way. But, wait. When I go to renew my driver’s license, I have to pay a fee. When I use the city’s water system, I get a bill in the mail. If I go to the store to buy groceries, there’s a sales tax. This can all be seen as reasonable, to a certain extent. Why? Because they are voluntary. Society may tell us that you need a driver’s license, or you have to live where there’s city water, or you have to purchase your food instead of growing it. But in all reality, you don’t have to. You could walk, ride a bike, take a taxi. You could move out of the city and install your own well to get water. You could grow your own food. It might be easier to just listen to what society tells you, but nobody is forcing you to. So that’s why these taxes are not as much of an issue for some free market thinkers; because in these instances the government is letting you choose. The issue where nearly all True Capitalists take offence, are the involuntary taxes, with the largest offenders being the property tax and income tax.

“It’s like being ticketed for picking up litter on the side of the street!”

Property tax is a recurring tax that a property owner must pay to the local city or county government based off the value of the land. The more expensive it is appraised at, the higher the tax. The problem with this tax is that even after the property is fully paid for, even if the land’s been in a family for generation, the government is still getting money from it year after year, and a failure to pay that tax could result in the government seizing the property. There is a word for a recurring price that one must pay to live in a specific place or else be evicted, and that’s rent. So if you’re continuously forced to pay rent on property you own, do you really own it? This is where many people take issue with the involuntary property tax.

On top of that, if an owner is to build any new structures on the property or make any noticeable improvements to the land, they might end up raising the value of the property enough to pay even more “rent” the next time the property appraiser shows up. So the owner pays for the new structures to be built/improvements to be made, and are then penalized for it by the government in the form of a higher tax! It’s like being ticketed for picking up litter on the side of the street! This ludicrous form of taxation is in direct conflict the True Capitalist principle of property ownership, that once it is owned, the owner has complete authority over the property and can utilize it however they see fit, without any interference from outside parties.

The other main involuntary tax is income tax. This tax conflicts with the philosophy of a True Capitalist as it is the government’s way of getting money directly from the people’s paychecks, reaping benefits from the worker’s labor before the worker even gets it in the first place. If the government were a person, there would be many words you could use to describe those actions. “Criminal,” “freeloader,” “thief,” “immoral,” and “selfish” are just a few that come to mind, but the government isn’t a person, so it’s allowed itself to engage in these disgraceful actions under the guise that it’s for the “betterment of society.”

Paying into Social Security is what a large portion of income tax goes towards. For a long time people were okay with this, as they knew they would be getting their money back once they retired, even though if one were to have put all that money into investments or retirement accounts it could have yielded better results, plus they wouldn’t be living off the government, but I digress. Social Security is starting to look less and less secure, however, with baby boomers retiring throughout the coming years, the country is faced with many people on Social Security, and fewer people paying into it. Due to the fact that the government is absolutely horrible at planning ahead and budgeting properly, the money that baby boomers paid into Social Security while they were working is long gone, spent on other programs or paid out to the retirees of the time. So, now, the money the boomers expect to receive must come from the current working population, which will be much too small to support the massive number of retirees that will be reached in the next decade. Social Security is marching towards its collapse, and the current working population knows this. Many millennials don’t expect to ever see Social Security benefits because they know the program won’t be able to last that long. So if the government is taking money under the promise that it will be given back when it is nearly certain that it never will, is that not theft? Why continue to allow the government to take the people’s hard-earned money when if someone were really passionate about benefiting society they would be better off donating to a private charity which would be infinitely more efficient than the federal government? Individually, a person can’t stop paying income tax without facing fines or even jail time, but a large enough push, if sustained for long enough with as many voices as possible, may be able to affect lasting change.

The Federal Government does many things that should be considered criminal, and involuntary taxes fit squarely into that category. They violate the very freedoms that a person should be entitled to, and threaten them with property seizure or jail time if they don’t comply. There is hope for change, if enough people become passionate about the issues and demand the change to be made. Sadly, the socialist push that is starting to be seen growing in America casts doubt as to whether a big enough push for that kind of change is possible in the coming years, but a True Capitalist must always remain resolute, planted in absolute certainty that they are speaking from the moral high ground, and constantly advocate for pure capitalism in the hopes that one day a person is free to do as they please, so long as it doesn’t hurt others or take what isn’t theirs. In the hopes that they aren’t penalized for improving the value of their property, and by extension the properties around it. In the hopes that their paycheck remains untouched and untaxed, because as we all know, taxation is theft.

Like True Capitalists? Make sure to follow us at the bottom of the page to get notified with every new post, and like and share our Facebook page!

Leave a comment